Council Tax is a charge set by the local authority for every property in the area. The money goes towards providing a range of services such as collecting your bins, funding local schools, road maintenance and so on.

The easiest way is to check online at www.gov.uk/find-local-council. However, you can also ask your landlord or letting agent and they should be able to tell you.

If you live in the London Borough of Camden, you must apply online via the Camden Council website.

The majority of students are exempt from the liability to pay Council Tax. If you live in a Hall of Residence, (UCL or University Of London), this will be granted automatically as these properties are exempt from council tax. If you do not live in a hall of residence then you will need to inform the Local Authority (Council) – Council Tax section - that you are a student. You can download and print a Statement of Student Status from Portico for this purpose.

To qualify for an exemption you must be:

- enrolled on a full-time course;

- attending a course that lasts at least one academic year;

- attending for at least 24 weeks in each academic or calendar year;

- required to undertake periods of study, tuition or work experience of on average at least 21 hours per week.

The exemption continues through all vacation periods.

The exemption does not apply to the period before you start your course and the period after you finish unless you are living in University Halls of Residence. You are liable to pay council tax, for example during the period before your course officially starts, if you've moved in early.

The husband, wife, civil partner or dependant of an international student is also exempt provided s/he has a condition in his/her visa preventing him or her from claiming public funds or from working. Children under 18 are exempt in all circumstances.

If the Local Authority refuses to give you the exemption, please contact the Advice Service; we can help you to explain the legal basis of exemption and why you are eligible for it to your Local Authority.

If you live in accommodation with an employed person or a part-time student, they will likely get a 25% discount on the council tax bill. This is because full-time students don't count as an eligible adult for council tax purposes and are exempt.

If you share with 2 or more people who are not full-time students, they are likely to be liable for 100% of the council tax bill. The non-student(s) will need to pay the bill but they might be eligible for discounts depending on their circumstances. Your local council can only pursue the non-students for payment of the council tax bill.

Some full-time students choose to contribute towards the council tax bill, even if they are not liable. It’s up to you and your flatmates to decide how to split the bill.

If you are studying part-time, then it is likely you will have to pay Council Tax as you will not qualify for the exemption. If you live alone, you may be able to qualify for a single person discount. You may also be able to apply for a benefit called “Council Tax Reduction” which helps people on a low income, or no income, pay their Council Tax. You’ll need to contact your local authority and apply directly to them for this benefit.

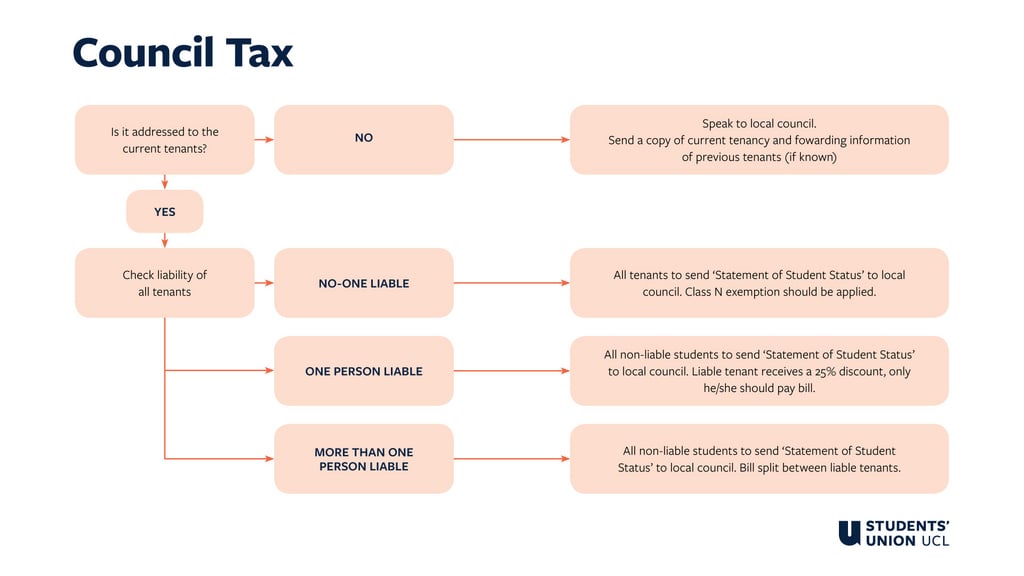

DO NOT IGNORE IT! If you receive a bill, even if you think it is incorrect or you should be exempt, then get in touch with the council to challenge the bill. Ignoring bills can lead to possible court action and even imprisonment. If you’re unsure then please contact the Advice Service who will be able to take a look at the letter and assist you. See the chart below to check your liability.

It’s possible that, as you are no longer enrolled on a full-time course, you may be liable to pay Council Tax. If you're thinking of withdrawing from your course and need advice on your liability for Council Tax, get in touch with the Advice Service and we can help. Similarly, if you’re thinking of taking a break from your course then please get in touch with us to see what your Council Tax liability may be.

You are only exempt from the period you start your course to the last day of your course. After that date, you are liable for Council Tax. You are probably also liable for Council Tax if you are between two courses, e.g. going from an undergraduate course to a postgraduate one after the summer.